Just like everyone else, I’ve watched those big market crashes on the news and thought, “Man, I wish I saw that coming!” I lost some money a few years back when tech stocks tanked. So yeah, dumb curiosity hit me hard last month – could I figure out when a bubble’s about to pop, without needing a fancy economics degree? Just see the signs, you know?

Started simple. Dug into old stories about famous bubbles everyone knows. Tulip mania hundreds of years ago. The dot-com craze. The housing mess in 2008. Read random articles, watched some YouTube rants. Wasn’t looking for complex theories, just patterns normal people might notice. Common threads.

Three big warning lights kept flashing:

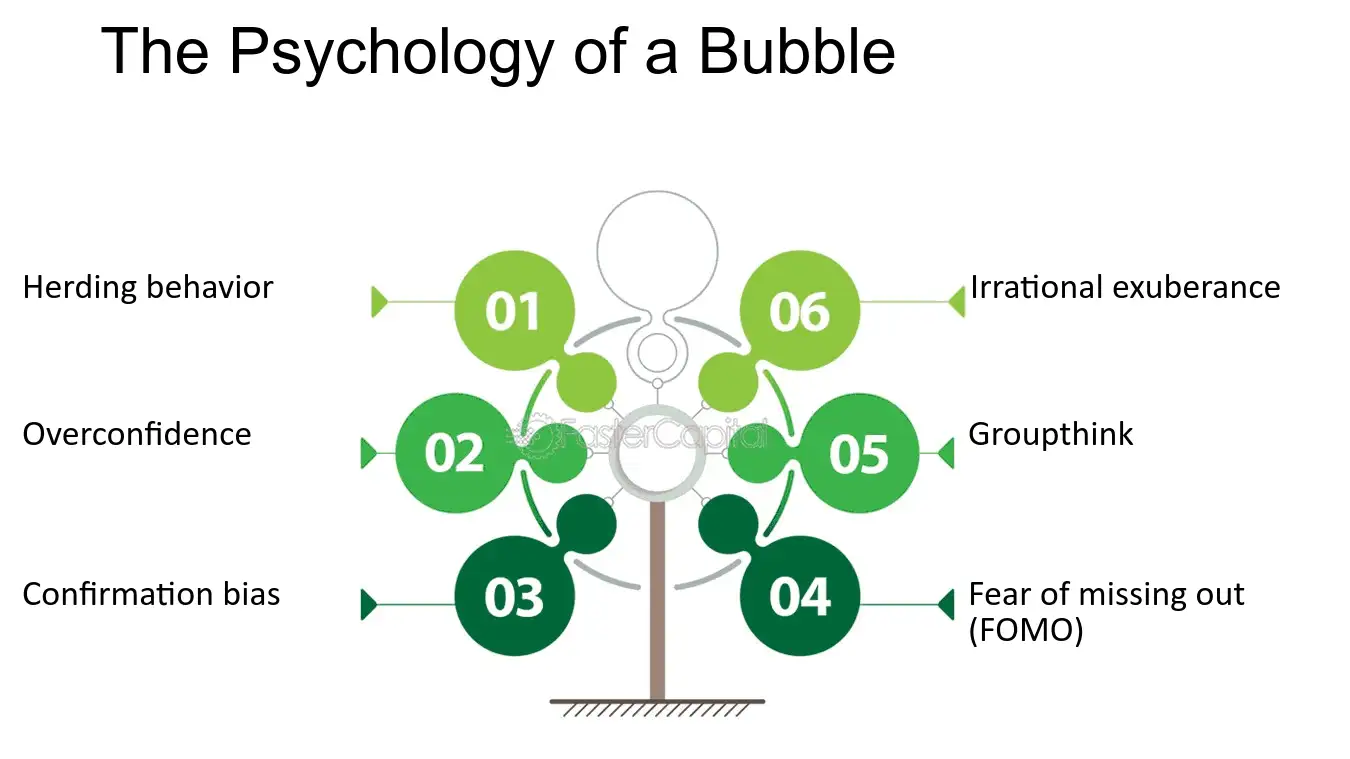

- Everybody Suddenly Becomes a Genius. Seriously. When the shoe-shine guy starts giving you stock tips, or your cousin who flunked math starts bragging about their crypto “investments”? Feels familiar. Everyone’s suddenly Warren Buffet. Saw this with crypto for sure. Everyone talked like they cracked the code.

- “This Time It’s Different” Mantra. Heard this constantly. Every bubble has it. Dot-com? “The internet changes everything!” Housing? “Property ALWAYS goes up!” Now? Probably AI or something else. When people brush off crazy price jumps with magic “new rules,” that buzzes my warning radar.

- Crazy Debt Explosion. Looked at charts for the 2008 crash. Woah. People borrowing stupid money they couldn’t possibly pay back if anything hiccuped. Lenders basically throwing cash at anyone breathing. When buying stuff, especially big stuff like houses or stocks, gets fueled by easy, cheap loans piling up? Dangerous.

Alright, theory time was done. Needed to test this. No crystal ball, but I could poke around.

First Target: That “Genius” Feeling. Started paying attention to conversations. Crypto bros had definitely cooled down. But then, noticed chatter around some EV startups. People who couldn’t explain how an alternator works were suddenly experts on battery tech stocks. Started feeling that weird, overly-confident hype again.

Then Debt. Looked at current numbers. Consumer debt? Way up. Auto loans? Seriously high. Interest rates climbing, but people still borrowing? That combo rang the 2008 alarm bell in my head.

“This Time It’s Different”? Yep, hearing it about AI stuff. “AI changes the rules!” “Old valuations don’t apply!” Classic.

So, what to do? Didn’t panic. But I acted.

- Took some chips off the table. Pulled profits from the riskiest stocks I owned that felt like hype magnets.

- Tightened my belt on new spending. Held off on that new car I kinda wanted.

- Stacked cash. Saved more aggressively than usual. Building a buffer felt smart.

Didn’t sell everything and move to a bunker. Just played it way safer. The signs were blinking too hard to ignore completely.

This isn’t rocket science, honestly. No magic formulas here. It’s more like noticing when the party gets too loud, too reckless. When everyone’s yelling “buy buy buy!” and common sense feels forgotten? That’s probably your warning to hold your drink a little tighter, check the exits, and maybe head home early.

Watching it unfold now. Feels tense. But at least I didn’t dive in blind this time. We’ll see how my ‘amateur bubble detector’ holds up!