Okay, so the holidays are coming up, and you know what that means – presents, food, travel, the whole shebang. It’s super easy to lose track of what you’re spending. I definitely learned that the hard way last year! So, this year, I decided to get my act together and actually track my holiday spending. Here’s how I went about it:

Figuring Out My Tools

First, I needed to figure out how I was going to track everything. I’m not a huge fan of complicated spreadsheets, so I ruled that out pretty quickly. I thought about just jotting things down in a notebook, but I knew I’d probably lose it or forget to update it.

Then I Started to find something easy to use.

Setting Up My Budget (The Scary Part!)

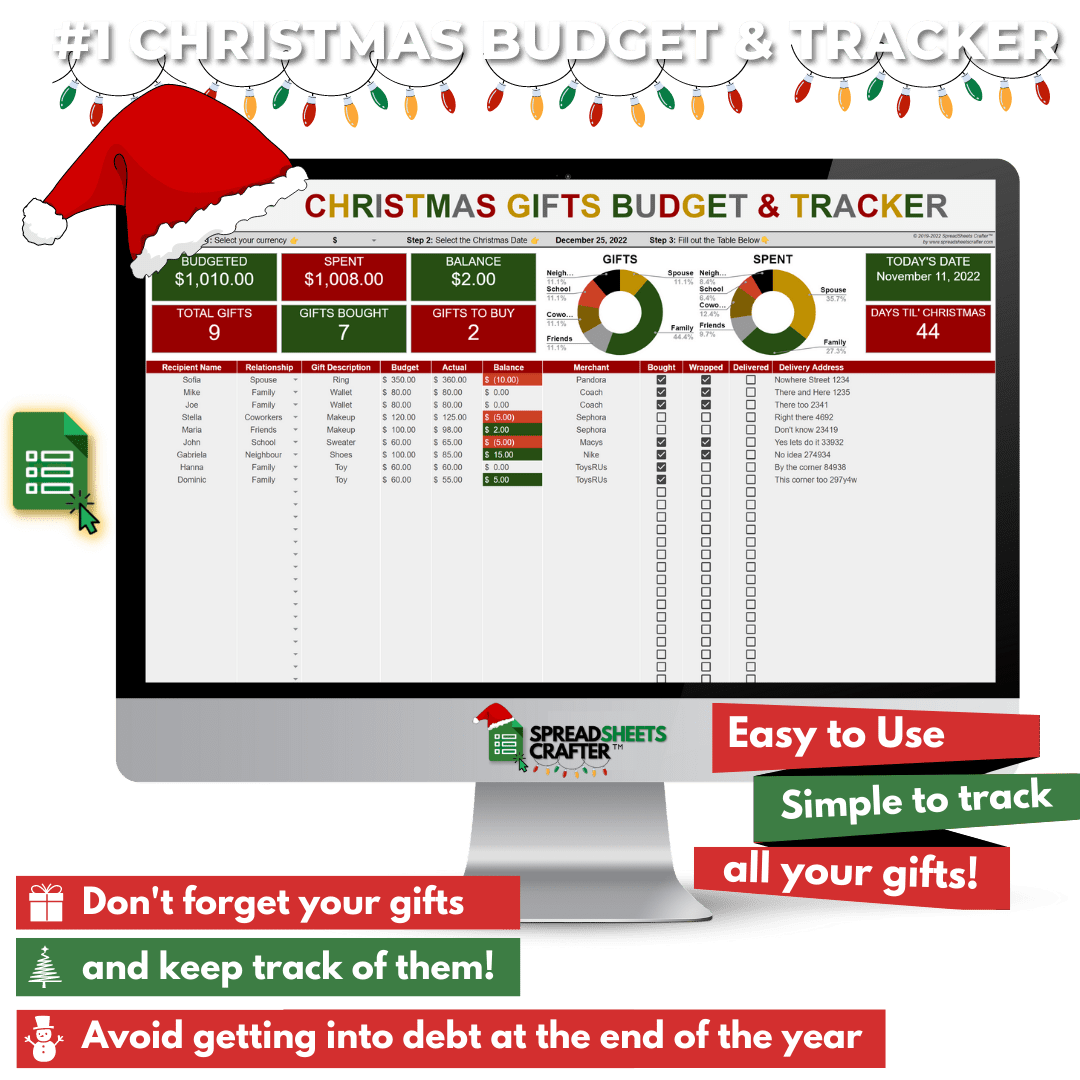

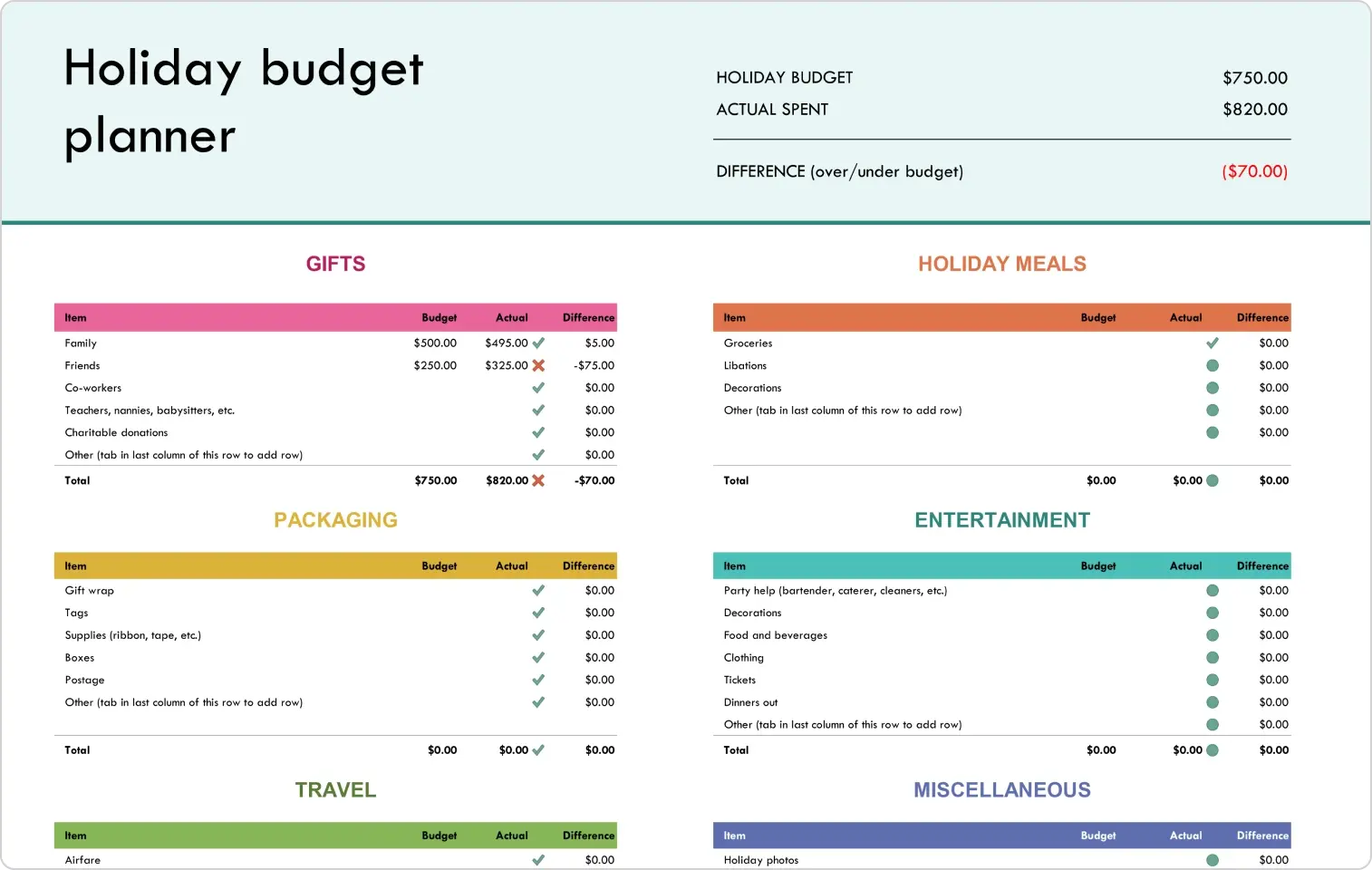

Next, I had to, you know, actually set a budget. This is always the part I dread, but it’s so important. I sat down and thought about all the different categories I’d need to budget for:

- Gifts: I made a list of everyone I needed to buy for and estimated how much I wanted to spend on each person.

- Food: Holiday meals can get expensive! I planned out what I wanted to cook and made a rough estimate of the grocery costs.

- Decorations: I love decorating, but it’s easy to go overboard. I set a limit on how much I could spend on new decorations.

- Travel: Whether It’s a plan or a bus,I make sure I get the number.

- Other: This was my catch-all category for things like wrapping paper, cards, and any unexpected expenses.

Once I had all my categories, I added up the estimated costs to get my total holiday budget. It was a little eye-opening, to say the least!

Tracking My Actual Spending (The Fun Part… Sort Of)

Now for the actual tracking. Every time I bought something holiday-related, I immediately put that thing to my list.

It felt a little tedious at first, but I got into a rhythm. And honestly, it was kind of satisfying to see the numbers in front of me. It definitely helped me stay mindful of my spending.

Reviewing and Adjusting (The Reality Check)

At the end of each week, I took a look at my spending and compared it to my budget. Some weeks were better than others! If I went over in one category, I tried to cut back in another. It was all about finding that balance.

The End Result (Phew!)

By the end of the holiday season, I actually felt pretty good! I had a clear picture of where my money went, and I even managed to stay (mostly) within my budget. It was definitely less stressful than last year, and I felt way more in control. I’m totally doing this again next year!